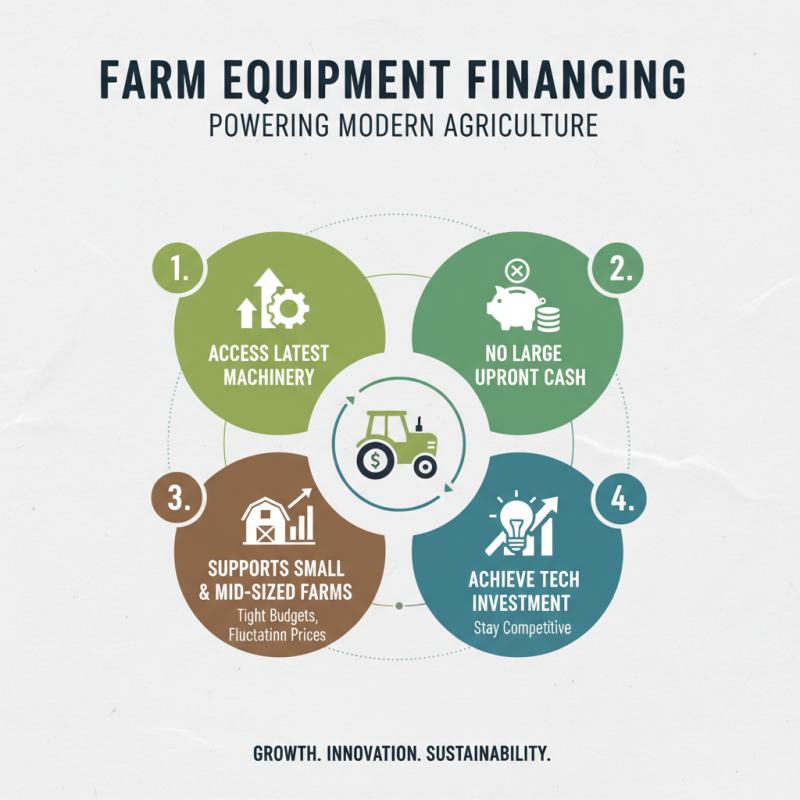

In the ever-evolving landscape of modern agriculture, farm equipment financing has emerged as a crucial tool for farmers. This financial solution enables producers to acquire the latest machinery without the heavy upfront costs. By investing in advanced equipment, farmers can boost productivity and efficiency on their farms. The benefits of farm equipment financing go beyond mere acquisition. They include better cash flow management which is vital for seasonal operations.

Many farmers find themselves at a crossroads when deciding between investing in new technology or maintaining their current equipment. With farm equipment financing, they can prioritize growth and innovation. However, some may hesitate due to concerns about debt. It’s essential for farmers to analyze their financial situation thoroughly before committing. Each decision regarding financing can significantly impact their business's future, requiring careful consideration.

Farm equipment financing plays a crucial role in modern agriculture. It allows farmers access to the latest machinery without immediate large cash outlays. This is especially helpful for small to mid-sized farms. They often face tight budgets and fluctuating crop prices. Investing in new technology can seem overwhelming, but financing makes it achievable.

Farmers can utilize financing to upgrade older equipment. This can lead to increased efficiency and productivity. However, not every financing option is suitable. Farmers must carefully evaluate terms and interest rates. A poorly chosen financing plan can lead to financial strain. Understanding the total cost of ownership is vital, as hidden fees can add up.

Maintaining cash flow is essential for daily operations. Financing can free up capital for other needs, like seed or labor. Yet, there is a risk involved. Payments must be timely to avoid penalties. Reflecting on the long-term impact of these choices is necessary for sustainable growth. Modern agriculture demands smart decisions, especially regarding financing options.

Enhanced cash flow management is vital for modern agriculture. Efficient financial planning ensures that farmers can invest in essential equipment while maintaining liquidity. According to a report from the American Farm Bureau, about 70% of farmers cite cash flow concerns as a primary barrier to growth. Equipment financing allows them to address these concerns effectively.

By acquiring machinery through financing, farmers can spread out their payments over time. This approach reduces the initial burden of large purchases. As per the USDA, 62% of farms utilize some form of financing for equipment to manage cash flow better. Proper use of these funds can lead to increased operational efficiency. Farmers can utilize the machinery immediately, increasing productivity right away.

However, this strategy isn't without challenges. High-interest rates on financing can strain budgets. Additionally, not all equipment financing plans are tailored to the agricultural sector's unique needs. Farmers must carefully assess their options. They need clear projections of how equipment will impact their profits. Making informed decisions can transform equipment financing from a hindrance into a solid pathway for sustainable growth.

Accessing the latest technology is vital for modern agriculture. Farm equipment financing provides a practical solution for farmers. With tight budgets, many find it challenging to invest in new machinery. Financing options allow farmers to acquire advanced tools without depleting their resources.

High-tech equipment can improve efficiency and crop yields. For example, precision farming tools help in monitoring soil health. This leads to better decision-making and resource management. However, some farmers hesitate. They worry about debt and repayments. Understanding the value of modern equipment can ease these fears. Embracing technology can lead to increased profitability and sustainability.

Farmers should also consider their unique needs. Not every new tool will suit every operation. A careful evaluation of options is essential. Sometimes, less flashy equipment can perform better for specific tasks. Taking time to reflect on purchases can prevent future regret. This balance between technology and practicality is key for success.

Farm equipment financing can significantly enhance operational efficiency in modern agriculture. According to a report by the American Farm Bureau Federation, nearly 75% of farmers have reported improved productivity after acquiring new machinery through financing options. With access to advanced technology, farmers can reduce time spent on tasks. For instance, modern tractors equipped with GPS technology can optimize planting patterns, leading to better yields.

Financing allows for timely upgrades to equipment. This helps farmers avoid costly downtime. The USDA's Economic Research Service highlights that farmers who invest in modern equipment see a 20% increase in output per acre. Such investments not only improve crop quality but also open new revenue streams. However, managing finances effectively is critical. Some farmers may struggle with high debt levels while attempting to modernize their operations.

Investing in equipment is not without risks. It requires careful planning and market analysis. According to Deloitte, only 40% of farmers feel confident in their financial management skills. This calls for continuous training in financial literacy. Farmers must weigh the benefits of new technology against the costs. Striking this balance will determine long-term success in modern agriculture.

Financing agricultural equipment offers significant tax advantages that benefit farmers. According to industry reports, more than 75% of farmers utilize financing options to acquire necessary equipment. Tax deductions can be substantial. For example, the Internal Revenue Service allows for Section 179 expensing, where farmers can deduct up to $1,080,000 on qualified purchases. This incentive directly lowers taxable income and encourages investment.

Additionally, interest on agricultural loans is often tax-deductible. This could lead to meaningful savings for farmers. However, farmers should approach financing carefully. While the potential benefits are clear, over-leveraging can strain finances. Many farmers face pressure to keep up with technology but must remain cautious. Balancing the need for modern equipment with manageable debt is critical for long-term sustainability.

Investing in farm equipment through financing should incorporate thorough financial analysis. Reports indicate that despite the advantages, approximately 30% of farmers underestimate the total cost of ownership. Understanding depreciation and maintenance is crucial. Tools that optimize productivity can ultimately lead to increased profits, but only if the investment is well-calculated.