In today's fast-paced agricultural landscape, the role of agricultural equipment financing cannot be understated. Farmers face many challenges, from fluctuating market prices to unpredictable weather. Without proper financing, upgrading equipment or investing in new technology can seem impossible. John Smith, a leading expert in agricultural financing, once stated, "Access to financing is essential for farmers to thrive in a competitive market." This highlights the importance of agricultural equipment financing in the success of modern farming.

Many farmers struggle with cash flow. A broken tractor or aging combine can halt operations. With agricultural equipment financing, farmers can obtain the necessary tools to improve productivity and efficiency. It allows them to make timely investments. However, not all financing options are ideal, and careful consideration is key. Many farmers overlook the fine print, leading to potential pitfalls.

Investing in agricultural equipment is a step forward, but it requires planning. Farmers should reflect on their long-term needs against immediate expenses. Poor financial choices can lead to debt and stress. Ultimately, agricultural equipment financing remains crucial, but it demands attention and diligence.

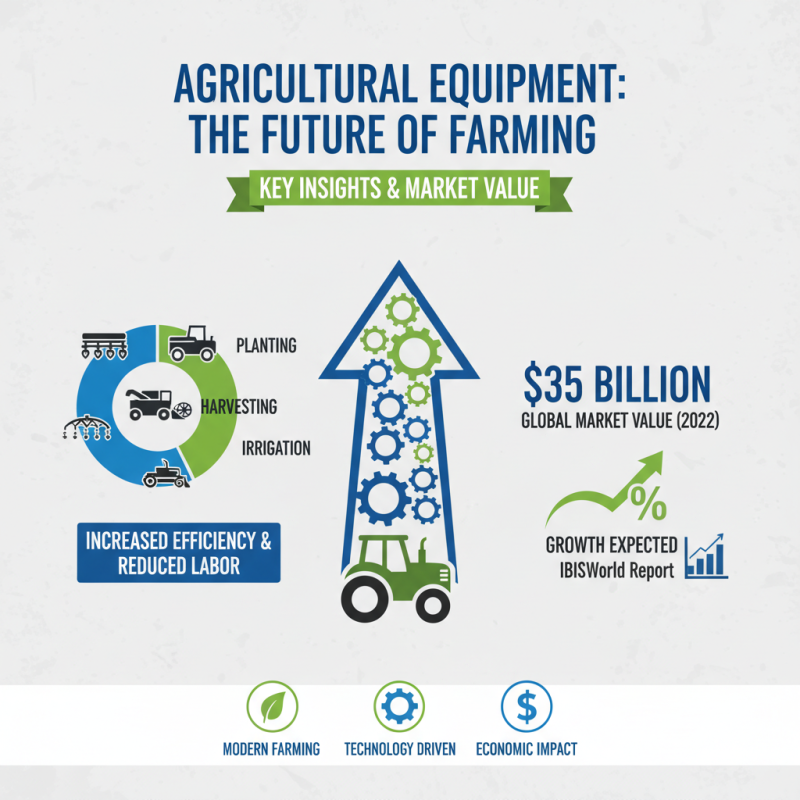

Agricultural equipment plays a vital role in modern farming practices. According to a report by IBISWorld, the agricultural machinery market was valued at $35 billion in 2022 and is expected to grow. Farmers now rely on advanced machinery for planting, harvesting, and irrigation. These tools increase efficiency and reduce labor costs.

Precision farming techniques have risen significantly. A 2023 study revealed that 75% of farms using precision agriculture saw a 20% increase in yields. Drones, GPS, and sensors are now common tools for monitoring crop health. However, many farmers struggle with the costs of new equipment. High upfront expenses deter investments. A solution lies in financing options.

Financing agricultural equipment enables farmers to acquire essential tools without immediate financial strain. A USDA report highlights that 41% of farmers use loans to finance machinery. This approach allows for more efficient farm management and improved productivity. However, some farmers may take on too much debt, leading to financial risk. Balancing equipment needs with financial sustainability remains a crucial challenge in modern farming.

Farmers today face numerous challenges when financing equipment purchases. High costs and limited access to credit create significant barriers. These issues can limit productivity and growth, impacting their livelihoods. Many farmers struggle to find lenders willing to finance necessary equipment. They often lack strong financial records or collateral.

Additionally, fluctuating market demands can make lenders hesitant. Farmers frequently face the risk of their investment not yielding expected returns. They might feel pressured to choose cheaper, less effective equipment, impacting their efficiency. A significant number of farmers also find themselves overwhelmed by loan terms that seem difficult to meet. As a result, the equipment they need for modern farming remains out of reach.

The complexity of the agricultural landscape adds another layer of difficulty. With unpredictable weather and changing agricultural practices, farmers need reliable tools. Yet, financing options often focus on short-term gains rather than long-term sustainability. More education around funding solutions may be necessary. Farmers need accessible resources to navigate these financing challenges effectively.

Farmers today face many challenges. Access to modern equipment can be a game changer. However, many struggle with the high costs associated with purchasing this equipment outright. Agricultural equipment financing offers a practical solution, allowing farmers to obtain the tools they need without overwhelming upfront expenses.

One benefit of financing is improved cash flow. Farmers can invest in new technology while keeping funds available for other critical areas, like crop production or labor costs. Imagine upgrading to precision farming tools that enhance productivity but knowing it fits within a manageable payment plan. This approach not only supports growth but fosters innovation in farming practices.

Another important aspect is the potential for greater efficiency. Newer machines often come with advanced features that save time and reduce labor. Yet, not every farmer feels prepared to take on financial obligations, but reflecting on the long-term potential is essential. Investing wisely can lead to better yields and ultimately a more sustainable farming operation. Balancing risks and rewards is key to making the most of financing options.

Investing in agricultural equipment is essential for today's farmers. It enhances productivity and efficiency. Proper financing options can make this investment manageable. Farmers often face high costs. Choosing the right financing method can be overwhelming.

One common option is equipment loans. These loans provide funds specifically for purchasing machinery. Lower interest rates can ease financial burdens. However, repayment terms can be tricky. It's important to understand the monthly obligations and interest rates. Some farmers might choose leasing instead. Leasing offers flexibility without the upfront costs. But at the end of the lease, equipment must be returned, and ownership isn't achieved.

Grants and subsidies are also available. These can help offset costs if farmers meet specific criteria. They often require extensive paperwork and proving eligibility. It can be a lengthy process, but the payoff can be significant. Understanding these different options is crucial. Each has its pros and cons. Farmers must evaluate their unique situations carefully.

Modern agricultural equipment significantly enhances productivity and sustainability. According to a recent report by the Food and Agriculture Organization (FAO), the adoption of advanced machinery increases crop yield by up to 30%. Farmers equipped with modern tools can plant, nurture, and harvest more efficiently. This leads to better food security and helps address the growing global demand for food.

However, not all farmers can access the latest technology. Financial barriers often impede the adoption of modern equipment. In a survey by the American Farm Bureau Federation, over 40% of farmers cited financing as a major challenge. Without support, many may struggle to upgrade or even maintain their existing equipment, ultimately affecting their output and sustainability efforts.

Tip: Consider exploring local financing options that cater to agricultural needs. These programs may offer lower interest rates or flexible repayment plans.

Investing in modern equipment is not just about efficiency; it’s about sustainability. Efficient machinery reduces fuel consumption and minimizes soil compaction. However, it's essential to balance modernization with environmental practices. Equipment that is not properly calibrated can lead to overuse of fertilizers, harming soil health. Awareness of this issue is crucial for farmers aiming for both productivity and environmental stewardship.

| Equipment Type | Financing Options (%) | Impact on Productivity (%) | Sustainability Benefits |

|---|---|---|---|

| Tractors | 70% | 25% | Reduces soil compaction |

| Harvesters | 65% | 30% | Minimizes crop loss |

| Irrigation Systems | 60% | 40% | Conserves water resources |

| Soil Testing Equipment | 55% | 20% | Optimizes fertilizer use |

| Pesticide Sprayers | 50% | 15% | Reduces chemical runoff |